Competitive intelligence (CI) sounds like hogwash to some and a holy grail to others. Many organizations try it out and chalk it up to “an expensive, fruitless endeavor.”

Truth is, they’re doing it wrong.

In this no-nonsense guide, we’ll go beyond the MBA-hyped-up textbook jargon and dive into the tactics that will actually make a difference.

But first, let’s make sure we’re on the same page about what competitive intelligence really is…

Competitive intelligence, as the name suggests, is the act of gathering data and insights about your competitors.

However, contrary to what many believe, the aim isn’t to take immediate action on this data. It’s to keep you well-informed about what’s actually going on so you can make decisions that improve your competitive stance in the market over time.

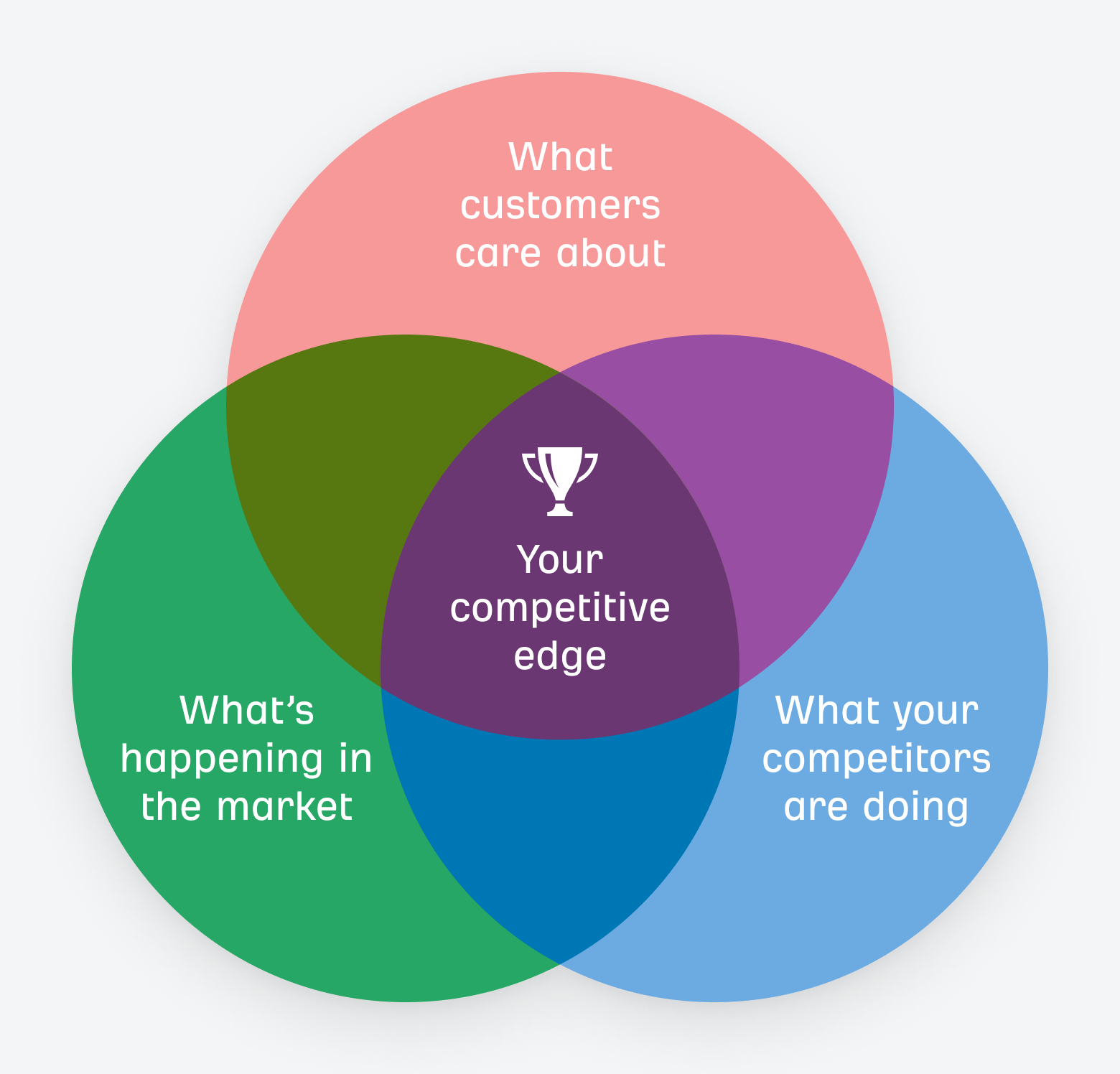

To do this successfully, you need to pay attention to three things:

- The things influencing your customer’s buying decisions.

- The state of the overall market.

- Your competitors’ positions in the market and their ability to influence buying decisions.

When you know the position of every competitor in the market and the direction they’re moving in, it becomes much easier to chart a course for success. Better yet, if you know the direction your customers are heading in, you can meet them there and become the market leader, ahead of your competitors.

Competitive intelligence has never been more important for businesses. Customers are not only more aware of your competitors but it’s now easier than ever for them to find multiple alternatives to you in less than three seconds.

When done right, a successful competitive intelligence program helps you:

- Gain a powerful advantage in the industry.

- Improve your market share.

- Make more informed decisions.

- Pivot your strategy when markets change rapidly.

But perhaps most importantly, competitive intelligence allows you to prevent competitors from taking over your turf.

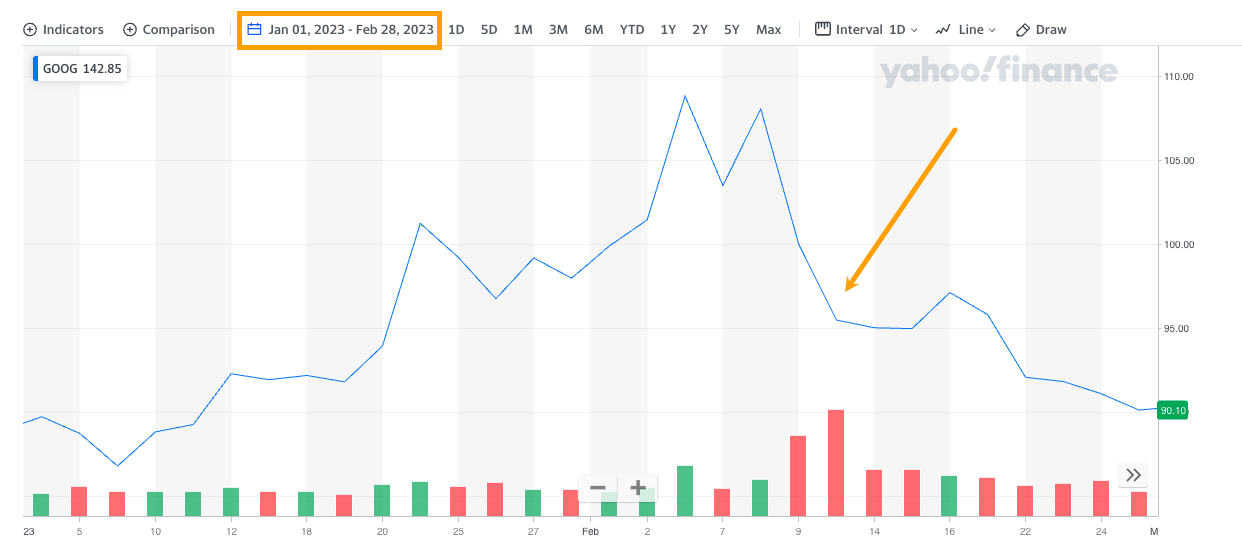

When Bing integrated ChatGPT into its search engine, Google was unprepared and had to scramble to keep up. In a matter of weeks, Google launched Bard, another generative AI model to compete with ChatGPT and keep Google in the AI race.

However, in its haste, Google’s model provided inaccurate responses and ended up causing a 7.7% market share loss, equating to over $100 billion lost overnight.

When done right, competitive intelligence programs help your company defend its flank so you’re in a much better position than Google was in this situation.

You can build your competitive intelligence program however you like. Here are some tactics to get you started. Pick the ones that you feel apply best to your industry.

Remember, CI is about knowing everything that’s going on and honing your instincts more than it is about taking immediate action.

Some tactics you can take action with today whereas others are best for the long run.

Customer analysis is about understanding what influences buying decisions within your market and who your customers think your competitors are (i.e., who else they are spending their money on).

While you can certainly gather data about your own customers, it is best to go beyond your data and understand buying decisions across the market as a whole.

How to do it

Gathering unbiased data about your customer’s buying decisions takes a little bit of grunt work but is well worth the effort. Here’s the process in a nutshell:

- Discover where your audience hangs out online and the platforms they frequently use.

- Figure out which competitors they can easily find across these platforms.

- Read conversations and reviews they’ve left (about you and competitors).

- Isolate the things they like or don’t like that influence their buying decisions.

For example, nine times out of ten your audience will use Google to help them find the product or service you offer. Since Google positions you alongside multiple competitors with every search, you need to gather data about what other companies are showing up for the terms most relevant to your business.

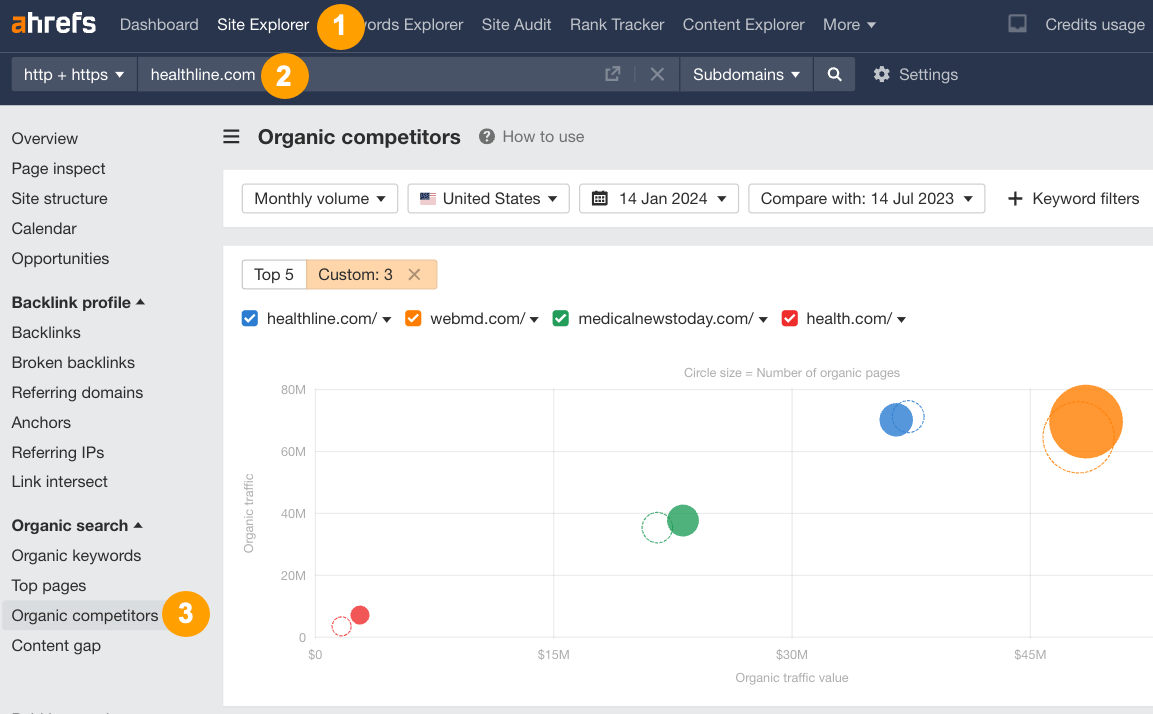

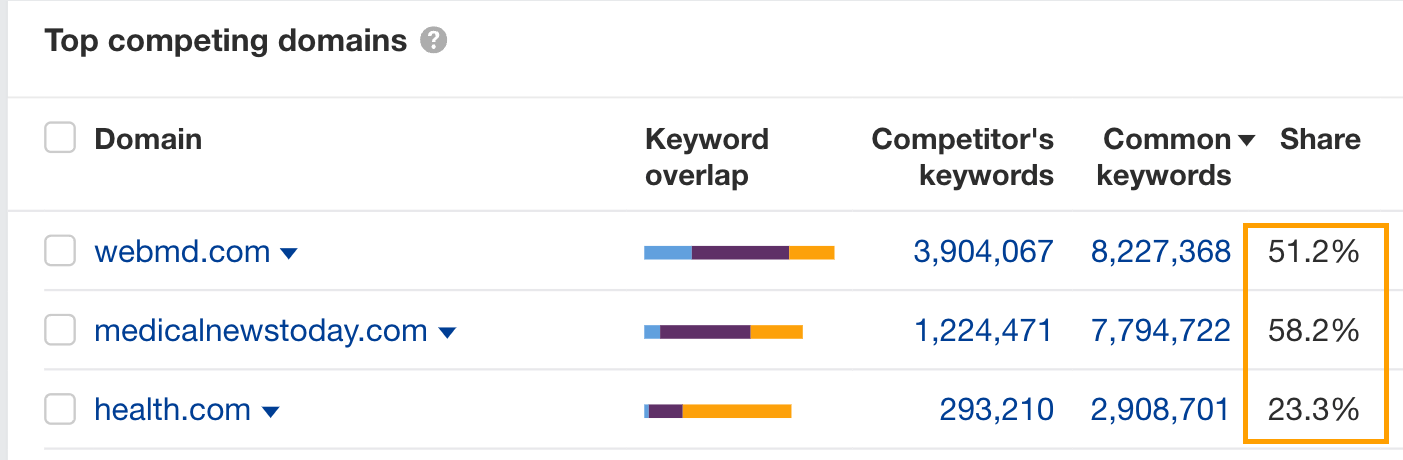

To find these, check out your website in Ahrefs’ Site Explorer and navigate to the Organic Competitors report.

Here you’ll see a list of websites that Google includes alongside yours when people look for the product or service you offer and what their share of visibility is.

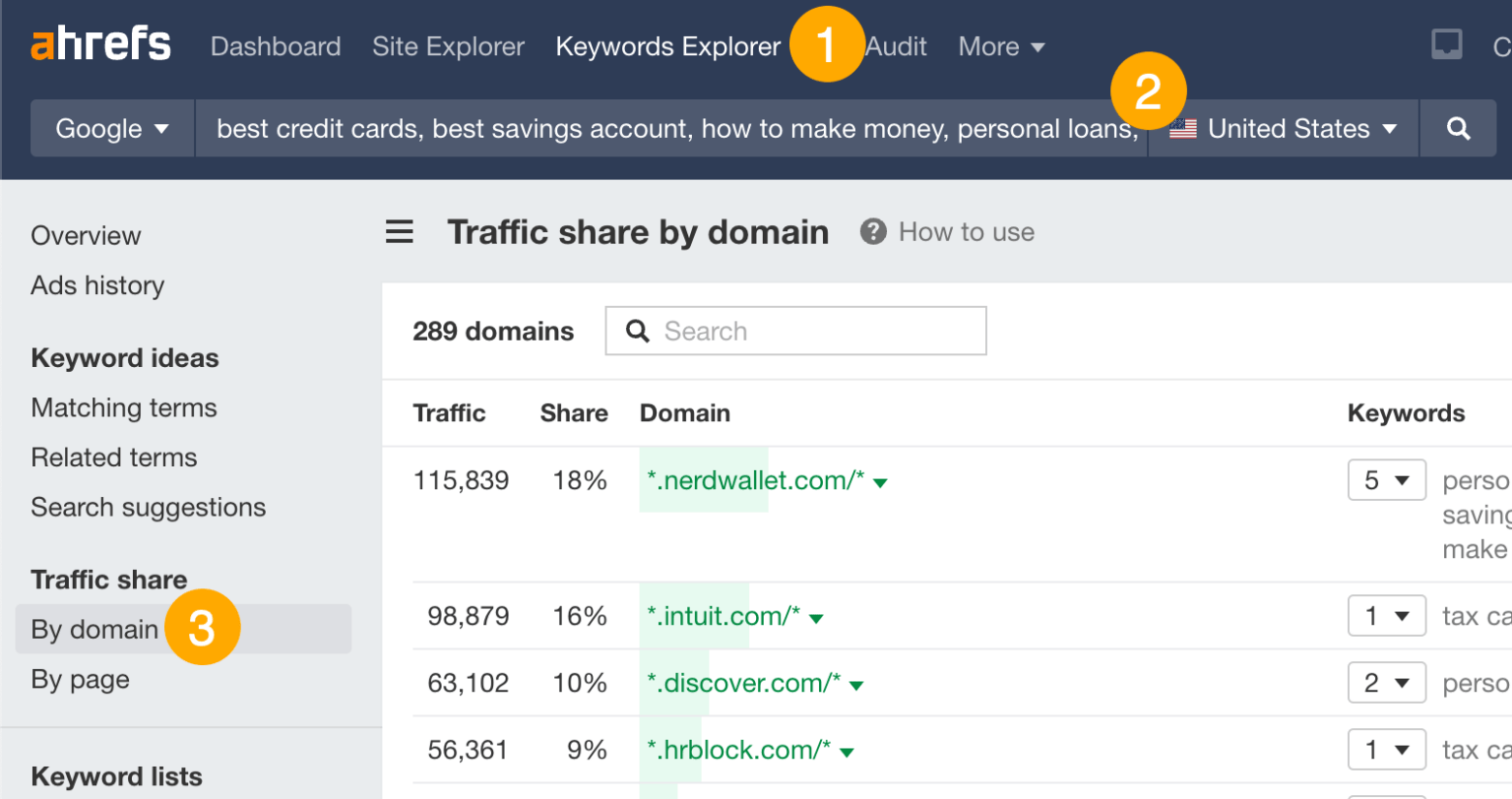

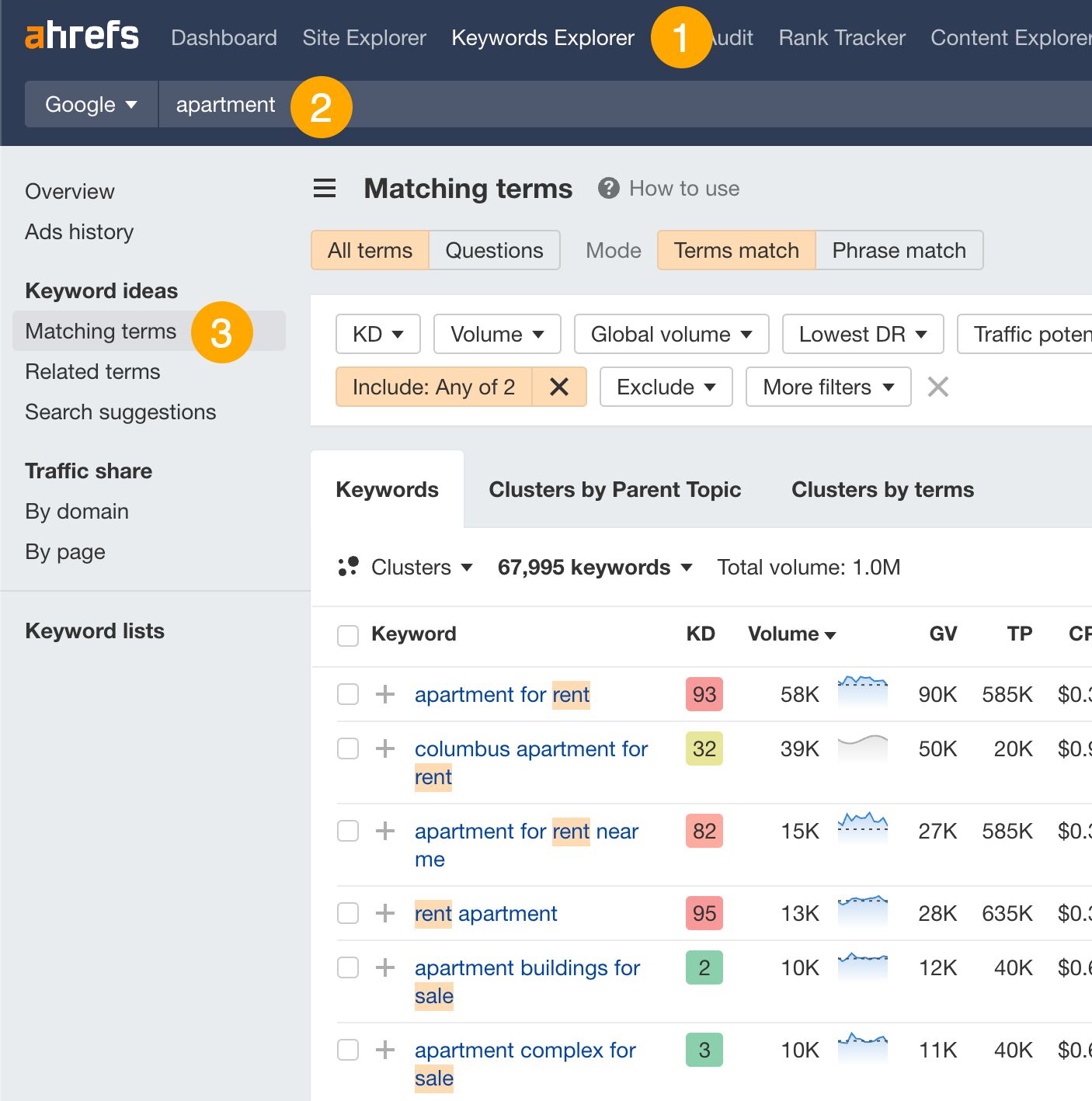

If your website is fairly new, you can instead search for your main topics, products, or services in Ahrefs’ Keywords Explorer. You can add a list of terms relevant to your business, its products, and services here. Then navigate to the Traffic Share by Domain report and see what websites are most visible for different queries.

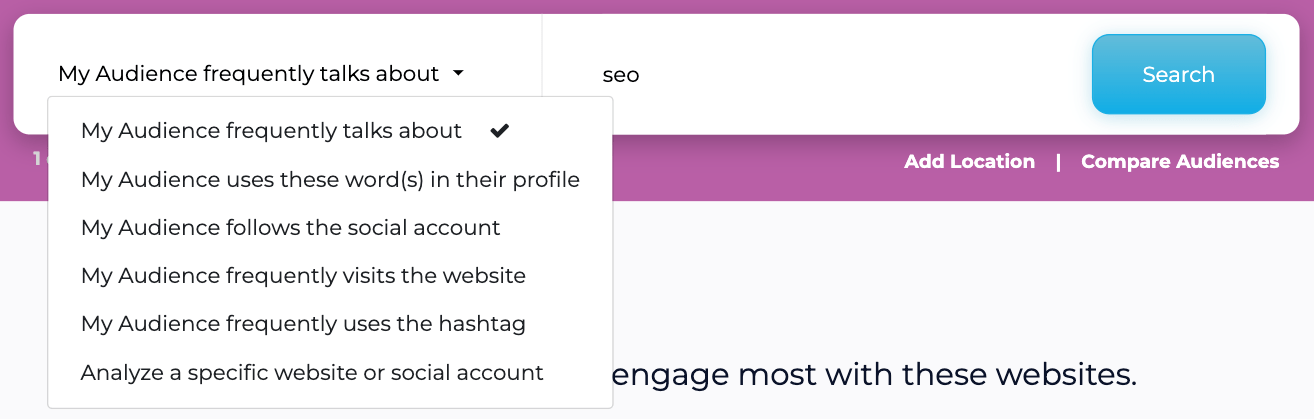

Beyond Google, you can also gather data about social platforms, forums, and multi-media content your audience interacts with frequently by using tools like SparkToro.

Then, check out where these people tend to hang out online. Pay close attention to the discussions they’re having and reviews they leave about what they like or don’t like about the products and services available to them in your market.

Also, pay attention to:

- Companies, products, and services mentioned a lot: These are who your audience sees as your competitors.

- Features and attributes frequently talked about: These are the things that influence their buying decisions.

- The overall sentiment around specific brands, products, and services: These are the unbiased things they like and don’t like about you and your competitors.

For each competitor you’ve identified (or that your audience frequently talks about), it’s worth creating a profile or playbook that stores data and allows you to observe patterns over time.

This tactic is all about figuring out what competitors are doing and how they’re thinking about the market—and then recording it so you can observe patterns over time. Go through this process every few months or at least once a year so you can track changes over time.

How to do it

There’s a lot of data you could monitor. Focus your efforts on the things that provide clues as to your competitors’ next moves and the direction they’re heading in. You can pay attention to:

- Their website and content: Are they targeting new topics, phrases or search terms that you can also leverage? Are they offering deals during certain times of the year?

- LinkedIn: What’s their headcount like? Has it grown? What kinds of roles have they hired recently and does this provide any clues about their next steps?

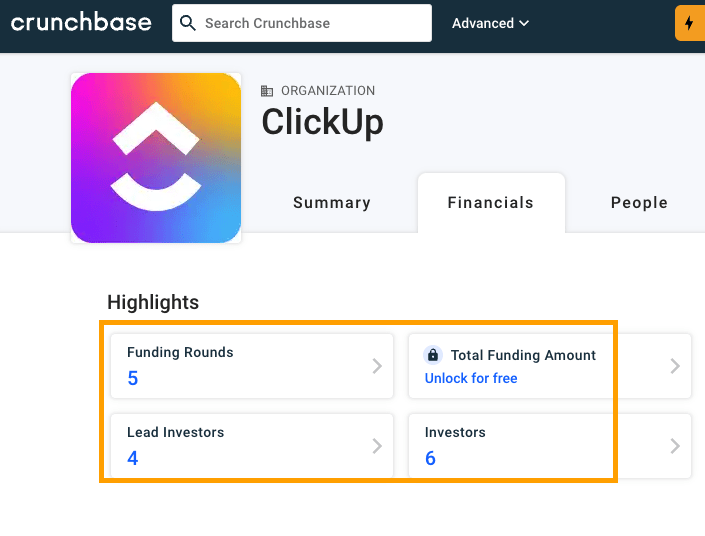

- Crunchbase: Are any of your competitors seeking funding? Or, have they raised more capital recently?

- Google Business Places: Have your competitors opened up offices in new locations? For a national business, franchise or multi-region operation, this may be a critical piece of data.

- Quarterly reports: Are any of your competitors publicly listed companies? If so, check out their quarterly revenue reports.

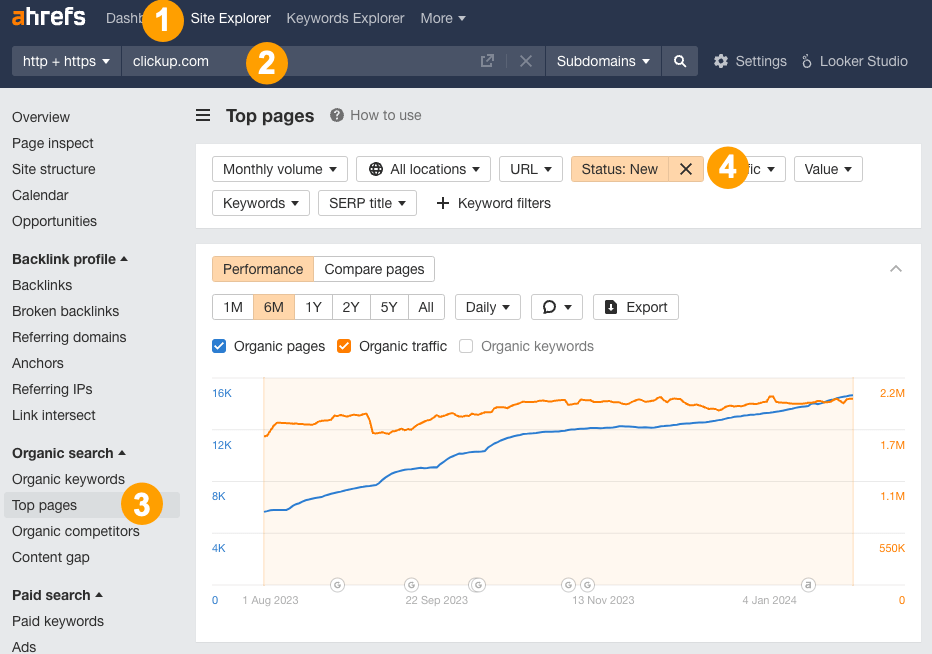

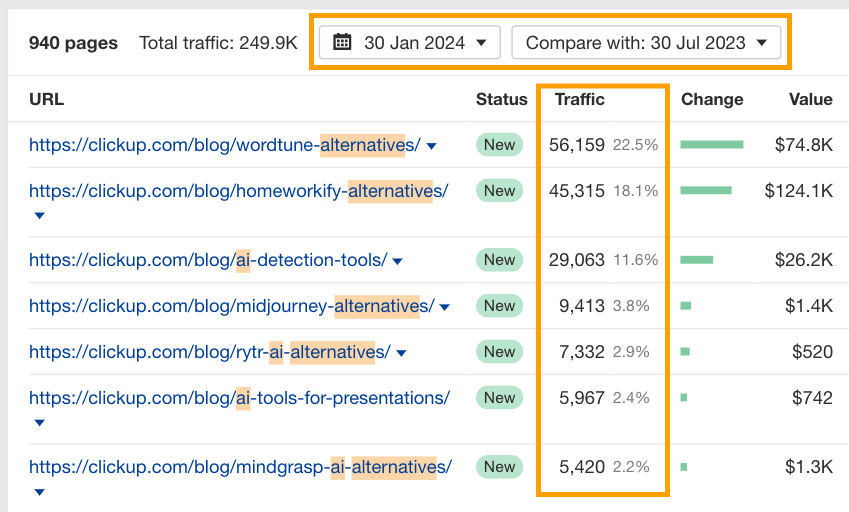

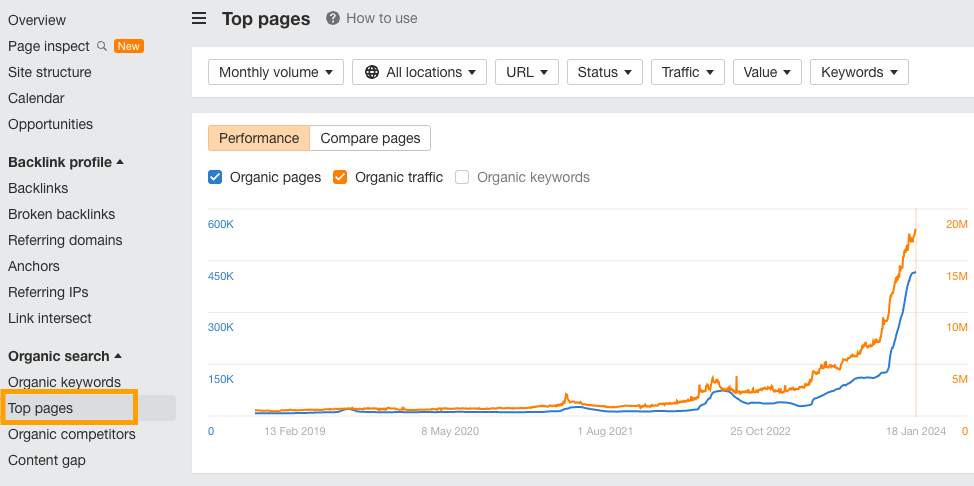

For example, if you plug ClickUp’s website into Ahrefs’ Site Explorer and filter for new pages in the Top Pages report, you’ll see they’ve published many blog posts in the last six months.

Of these, there are a number of posts about topics like AI and software alternatives that have gained a lot of traffic in a short period of time.

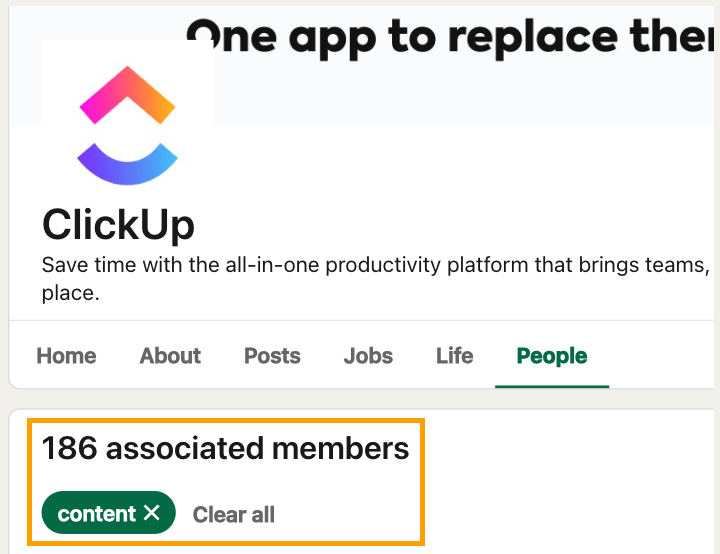

If we check LinkedIn, we can see that out of 1062 staff, 186 (17.5%) are involved with content in some way.

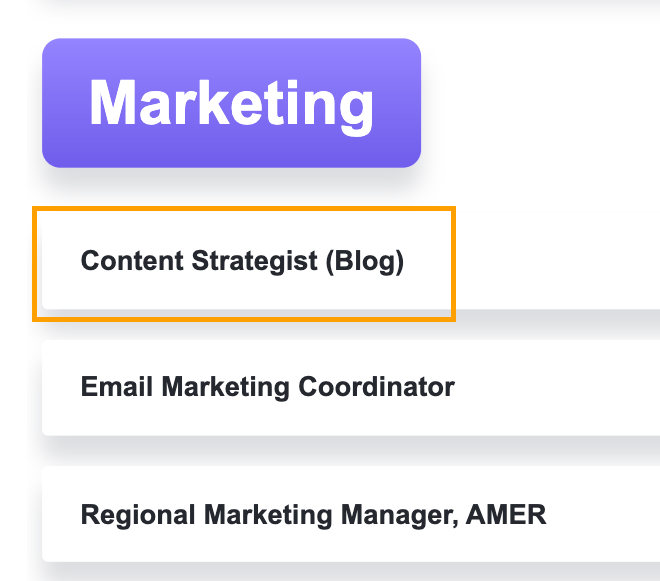

And they’re also hiring more content strategists according to their careers page:

Then overlay data from Crunchbase about their funding rounds:

The picture we start to see with these data points is that ClickUp is a well-funded company, investing rather heavily in its content strategy.

There are of course more nuances that you can dig deeper into, but overall, these are the sorts of insights you want to record and keep track of over time.

In doing so, it will become obvious if they do something totally different. For instance, if they hypothetically start hiring AI engineers, it could be a sign their content or product strategy shifted more heavily into the realm of AI. Especially if they’re simultaneously publishing more content about alternatives to AI tools.

The possibilities are endless, but you get the idea.

You can easily monitor each of your competitors’ marketing and communications materials with alerts.

Not only can you learn where they are being mentioned online, you can also reverse engineer where they spend their marketing budget and what channels are working best for them.

How to do it

Start by setting up a dedicated email account to receive a copy of all the marketing materials your competitors put out there. A free Gmail account you can share with your team should do the trick.

Then, subscribe to all the channels your competitors post content in, like:

- Email newsletters

- Social profiles

- YouTube channel

- Podcasts

- Blog RSS feeds

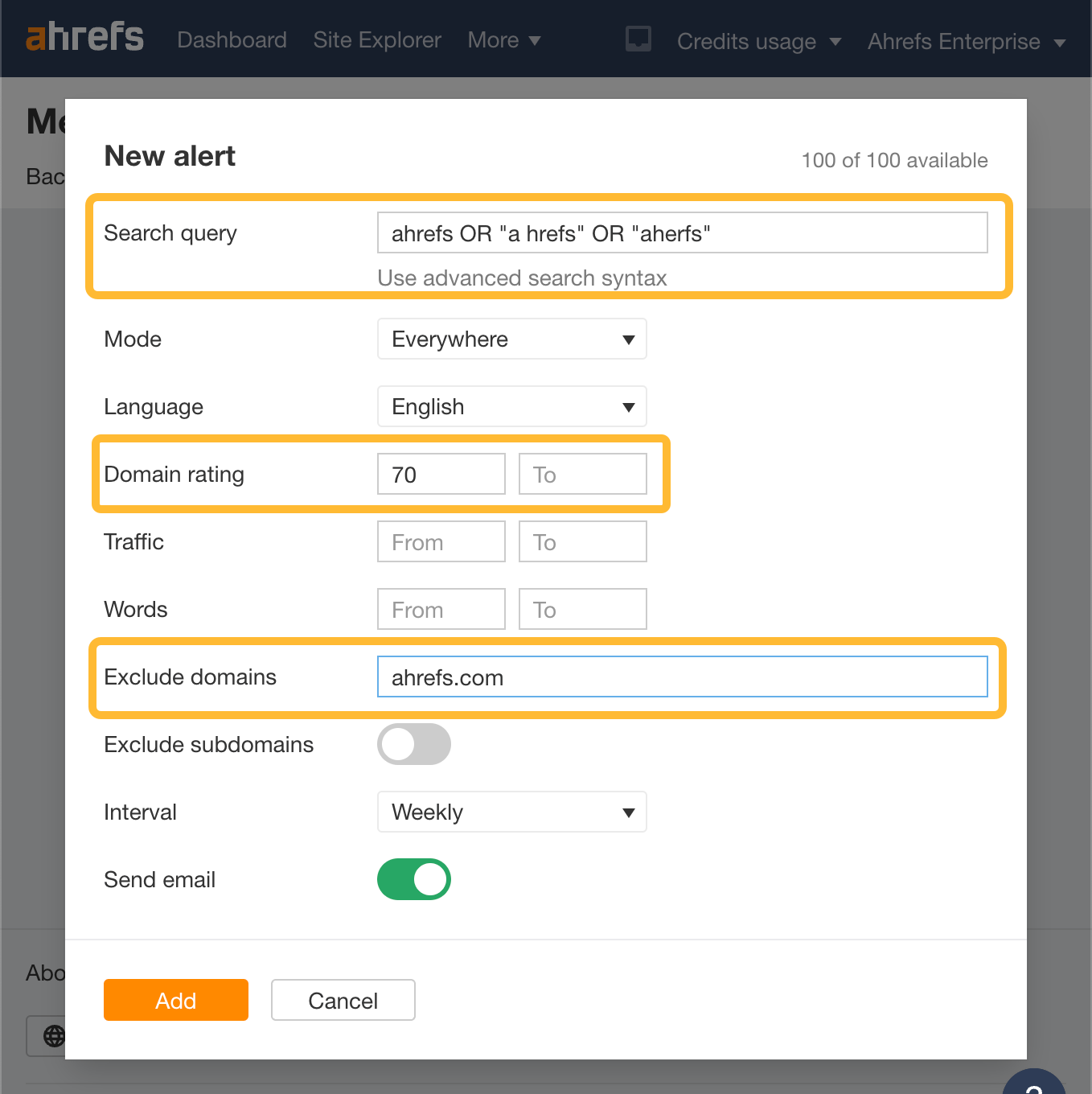

Make sure you also set up alerts like Ahrefs’ Alerts or Google Alerts to track media and brand mentions on other people’s websites.

Google Alerts will track every mention and can quickly clutter your inbox. In Ahrefs, however, you can use the Domain Rating (DR) filter to restrict alerts to those from big brand websites only. This can provide more focused insights into your competitor’s digital PR efforts.

To set these up in Ahrefs, go to Alerts > Mentions and add a new mention for each competitor taking care to exclude the competitor’s own domain. Set the DR filter to something high like 70+ to filter out mentions on small websites.

If you wish to track multiple terms for each competitor, set up a new alert. For instance, you may wish to track their brand name mentions separately from mentions of their branded products or features.

Forward these alerts to the new email you set up to receive automated updates.

advanced tip

It pays to pay attention to the messages each competitor is sharing. Are they heavily promoting a specific feature or selling proposition?

If so, cross-reference the competitor’s reviews on third-party platforms, like TrustPilot, to see if customers are mentioning it.

- Are they investing in a thing no one cares about? → If customers aren’t talking about it, it may be a sign it’s not worthwhile. Wait it out before you start investing in the same thing.

- Are they focusing on something their customers are still complaining about? → This may be a sign they got it wrong and could be an opportunity for you to sweep in with a better solution.

- Are customers loving the thing they’re promoting? → It’s likely they are directly influencing buying decisions with this feature and it’s worth further consideration for your business.

Historical insights are a goldmine of valuable information. For each of your competitors, you can:

- Track the history of their growth on different platforms.

- Monitor how they’ve evolved over time.

- Identify annual seasonal trends in sales or marketing messages.

- Learn from their past mistakes.

How to do it

There are many data sources you can use to gather historical insights about your competitors.

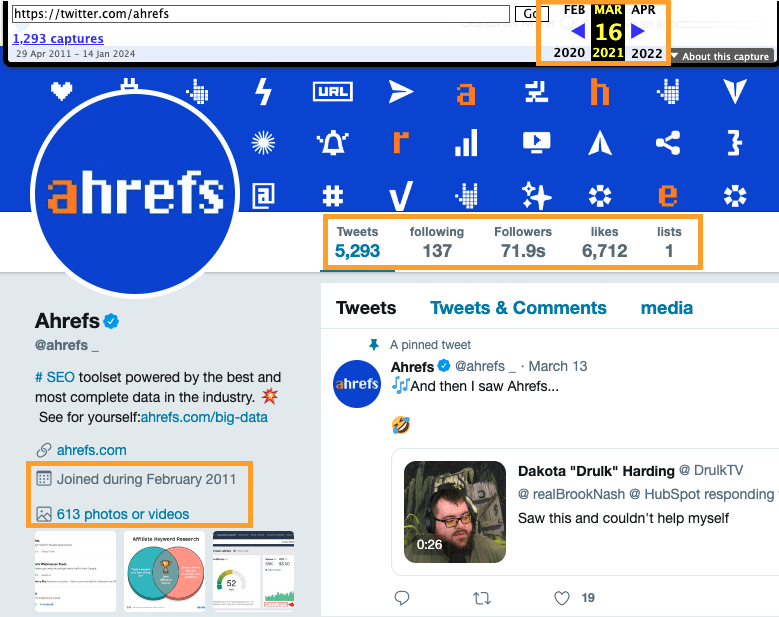

Wayback Machine is my favorite place to start. It gives you a visual history of web pages that you enter and can also provide some historical snapshots of various social platforms too. For example, here are the stats of our Twitter account in March 2021:

You can see how big our following was, how much content we had published, and more. You can find similar insights on your competitors too if you take the time to investigate their history.

The only caveat with Wayback Machine is that it tends to work better for web pages that get a lot of visits. If your competitors are on the smaller side, you may not find much here. It also doesn’t work for every social media platform. I’ve had better success with YouTube and Twitter than Instagram or Facebook for instance.

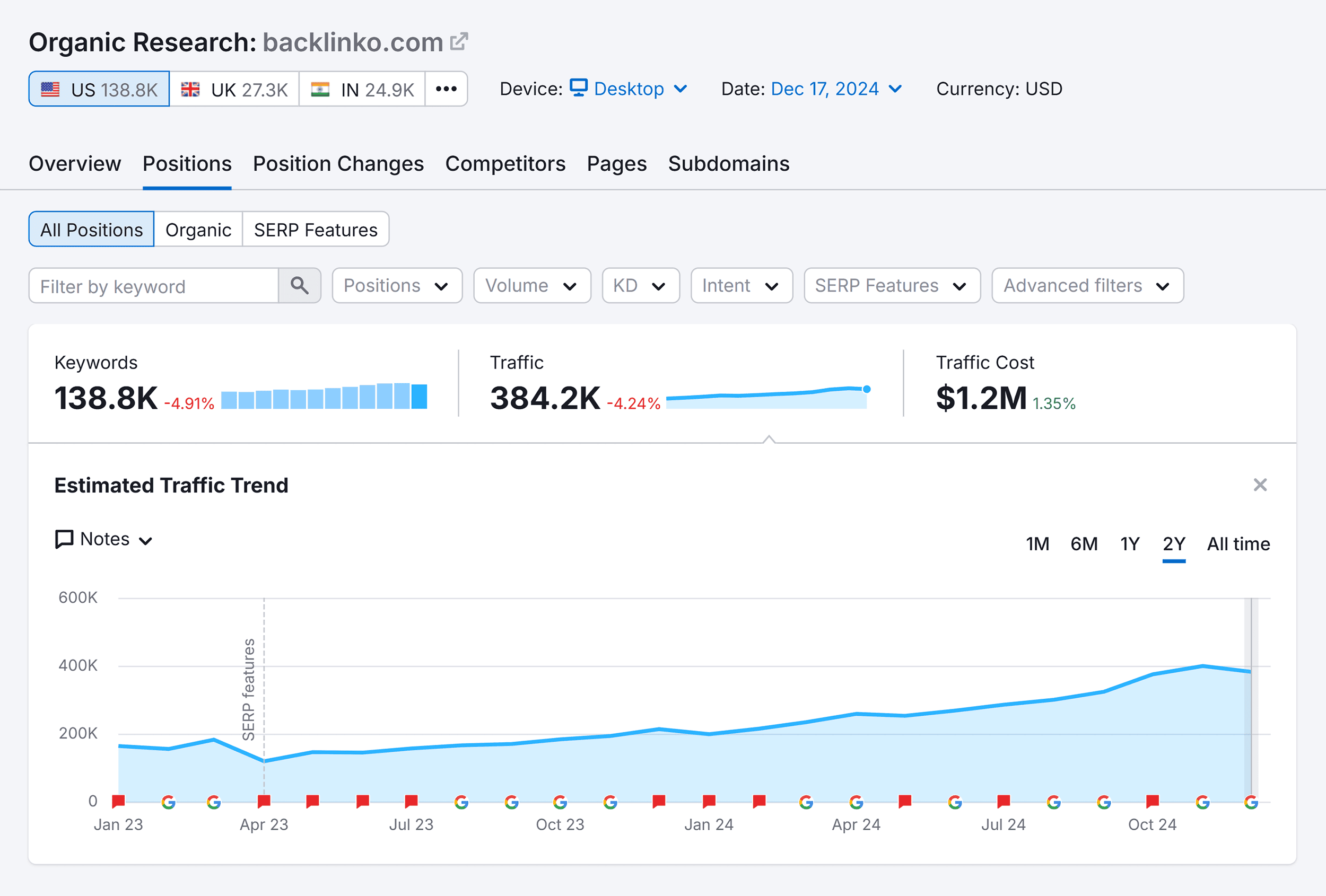

Another place to check for historical data is Ahrefs. You can track the history of your competitor’s organic website growth in Site Explorer > Top Pages to identify their content marketing history.

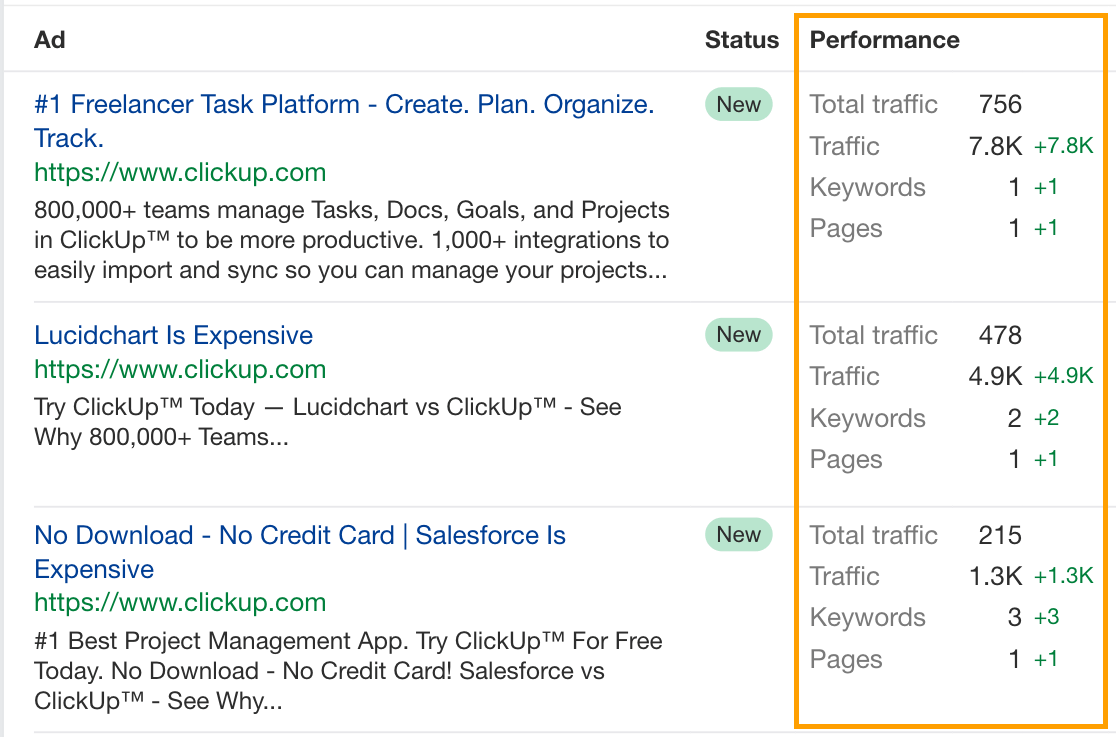

And if you want to get extra crafty, check out the history of their paid ads in the Paid Search > Ads report.

In this report, you can not only see which ads get the most traffic, but you can also see their ad copy, which pages they are boosting the most, and which competitors they’re hitting the hardest with their ad titles.

For example, check out some of the different ad messages ClickUp has tested out over the last year, and the performance of each:

Not to mention how they’re tailoring their messaging to compete directly with Salesforce and Lucidchart. Lots of competitive insights you can gather here!

Sometimes, the best way to know what’s going on within a competitor’s company is to hear it directly from the source. Following the content published by key members of the company will provide a wealth of insights about what they’re doing and how they’re thinking about the market.

How to do it

Identify all of the key people within each competitor’s company. Go beyond the C-Suite executives and also think about people like:

- Board of Directors

- Investors

- Employees in roles of interest

- Industry partners or SaaS platforms they use internally

For each person of interest, follow their social media posts, keep tabs on their personal websites, subscribe to their email lists, and monitor the key ideas they are talking about in forums and comments. You can set up alerts for each person of interest in Ahrefs and funnel emails to a dedicated inbox as frequently as you like.

More often than not, the latest ideas they’re talking about are inspired by what’s going on within the company they work for. For example, our CMO Tim Soulo regularly shares insights about our new product features on Twitter:

The concept of a “unique selling point” is not new. However, its meaning can often get lost when brands search for the latest hype or buzz to follow and tout those as their USP.

Being able to articulate exactly what makes you unique and who should care about your point of difference matters.

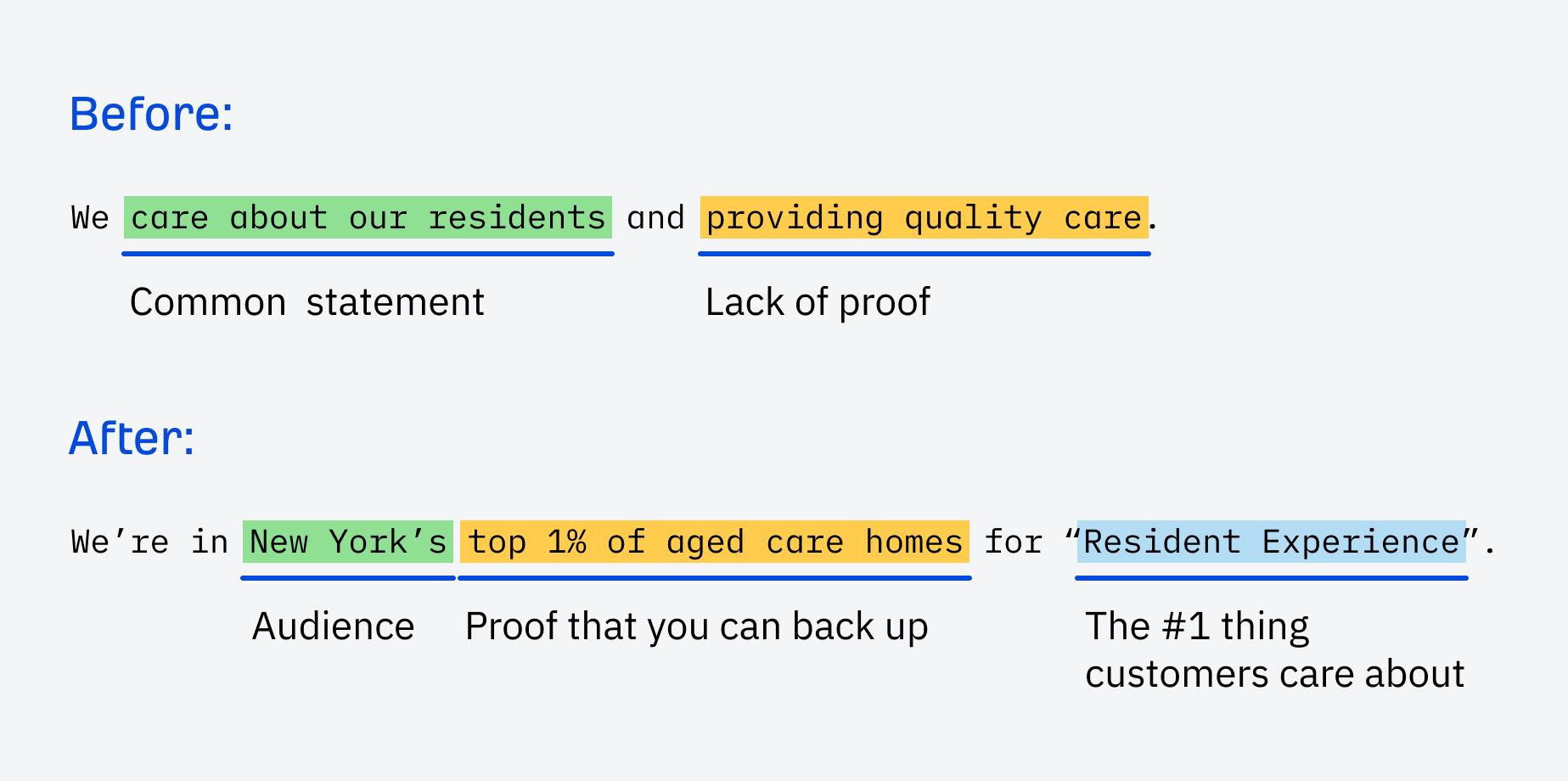

It’s like an aged care home saying “we’re different because we care about our residents.” Name one aged care home that won’t say something to this effect. This then leads to the point, if everyone is saying it, and it’s true, then it’s not unique, obviously.

Articulating your awesomeness is less about you and more about the things your audience cares about.

How to do it

Remember how I harped on about understanding what affects your customer’s buying decisions at the start of this post?

This is where you get to use that knowledge.

Surprisingly, many people will care about other things before they care about price. For example, in the aged care industry, the resident’s experience is a far more important decision-making factor than price.

So, go looking for data that can help you position your brand as the best in the area for resident experience (or whatever the equivalent is in your market). Check out:

- Competitors’ reviews for customer sentiments

- Publicly available comparative data from trustworthy sources

- Data you gather from tests you’ve run

I did this recently for a client and we were able to compare their facility with over 140 others in their city using publicly available government data.

Based on the data, my client is ranked in the top 1.26% for “resident experience.” Better yet, their rooms are up to 50% bigger and 33% cheaper than competitors. This is a powerful USP to share that genuinely sets them apart.

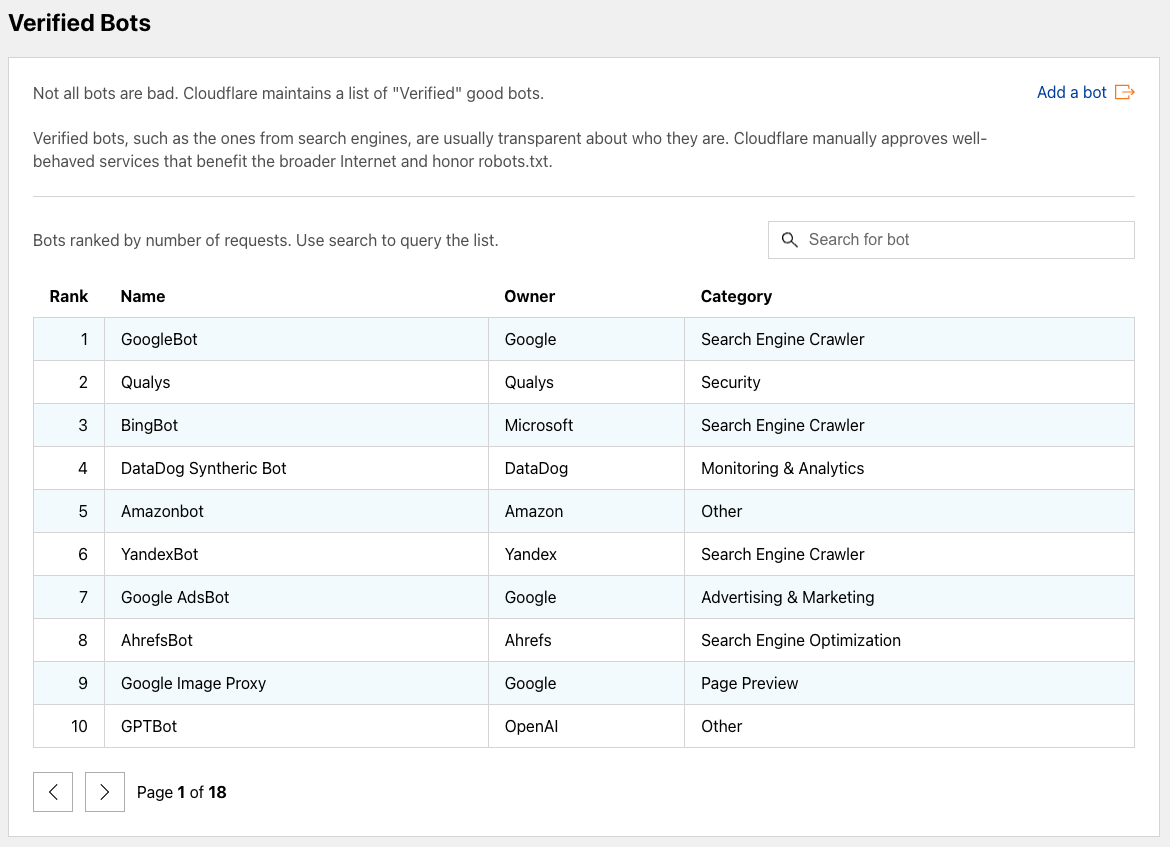

Similarly, at Ahrefs, one of our core USPs is that our crawlers are among the internet’s most active and gather petabytes of data. Our customers can verify that our crawlers are right up there alongside Google’s thanks to publicly available data from Cloudflare:

Articulating your awesomeness shouldn’t be taken lightly. It’s your best chance to show your potential customers what truly makes you different and why they should care.

Sometimes, your price strategy is what makes you different. Other times, it helps to know how your pricing compares and whether competitors make any changes that affect your overall position in the market.

How to do it

Depending on the type of business you run, you may need to use different strategies.

For instance, if you run an eCommerce store or your competitors freely share pricing on their websites, you can use a free data extraction tool like Browse.ai to compile your competitors’ pricing on an automatic schedule.

In high-ticket or B2B verticals, prices are generally not publicly available. You can hire a mystery shopper to go through the sales journey with each of your competitors and record every step of the process on your behalf.

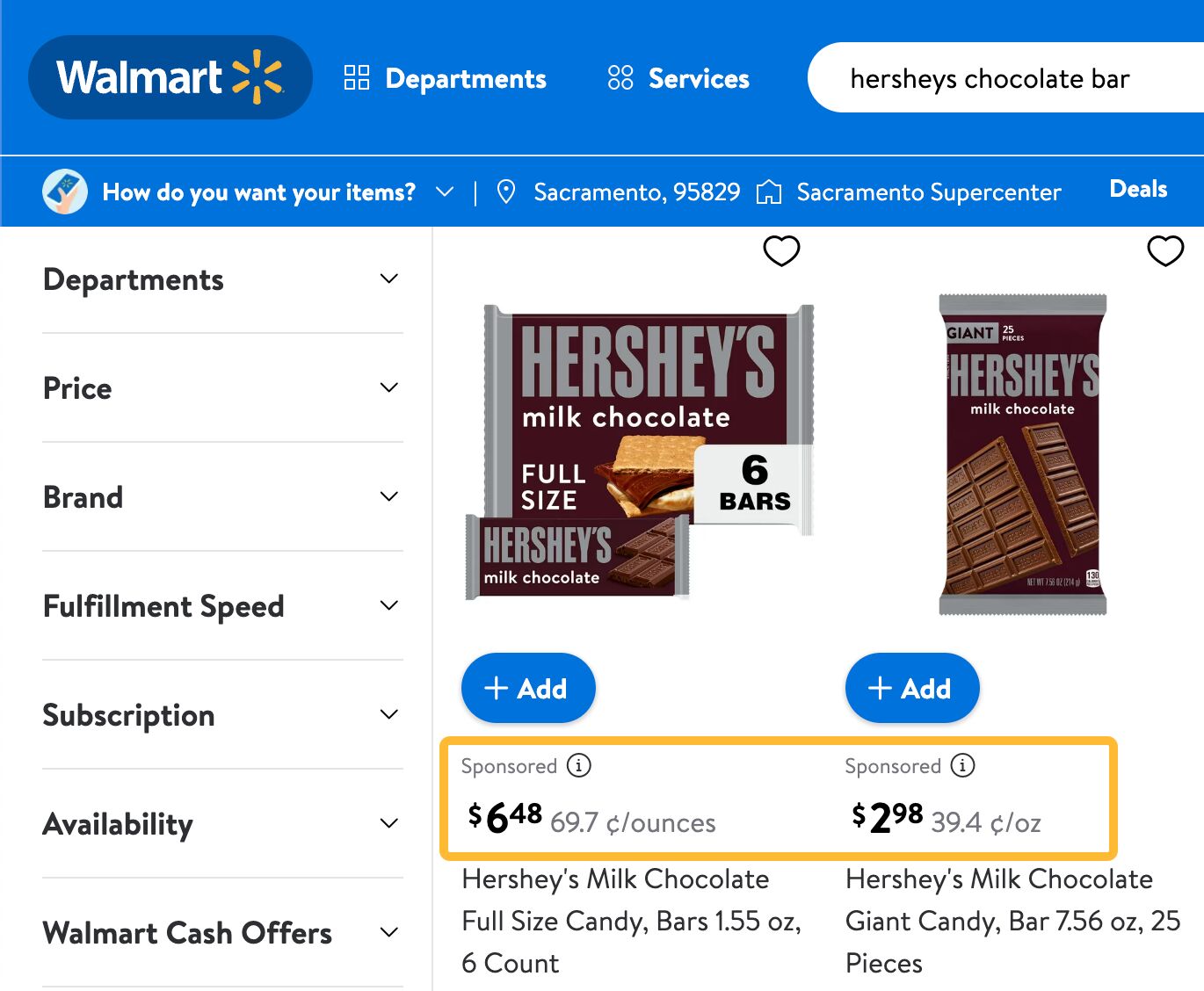

In some industries, you may also find your competitors’ prices listed on marketplaces they sell through instead of their website.

For example, Hershey’s website has no prices for their candy. But you can find them via other retailers’ websites like Walmart:

In any case, pricing is often something that you may have little control over. But knowing how your company compares is enormously helpful for sales teams, especially so they can handle objections.

There’s nothing wrong with being priced higher than the market average. It’s also totally fine not to discount your products to attract more sales. If this is your pricing strategy, lean into it and educate the market on what corners your competitors may cut to offer dirt-cheap rates.

In some markets, consumers want a solution that is not currently available, yet is something you can easily supply them with. This is a product or service gap.

How to do it

You’ll need to overlay two different data sets to find the best opportunities:

- What your customers want

- What you and your competitors deliver

If you gather all the info on what customers are searching for and you notice neither you or your competitors are delivering something they are frequently searching for, there’s your gap.

In Ahrefs, you can gather both of these data sets, and track progress over time.

To find what your customers are searching for, use Keywords Explorer. Just enter a broad topic and check one of the keyword ideas reports on the left menu to see the most popular searches.

Sidenote.

If the results are too broad, use the “Include” filter to refine your search (that’s what I did above).

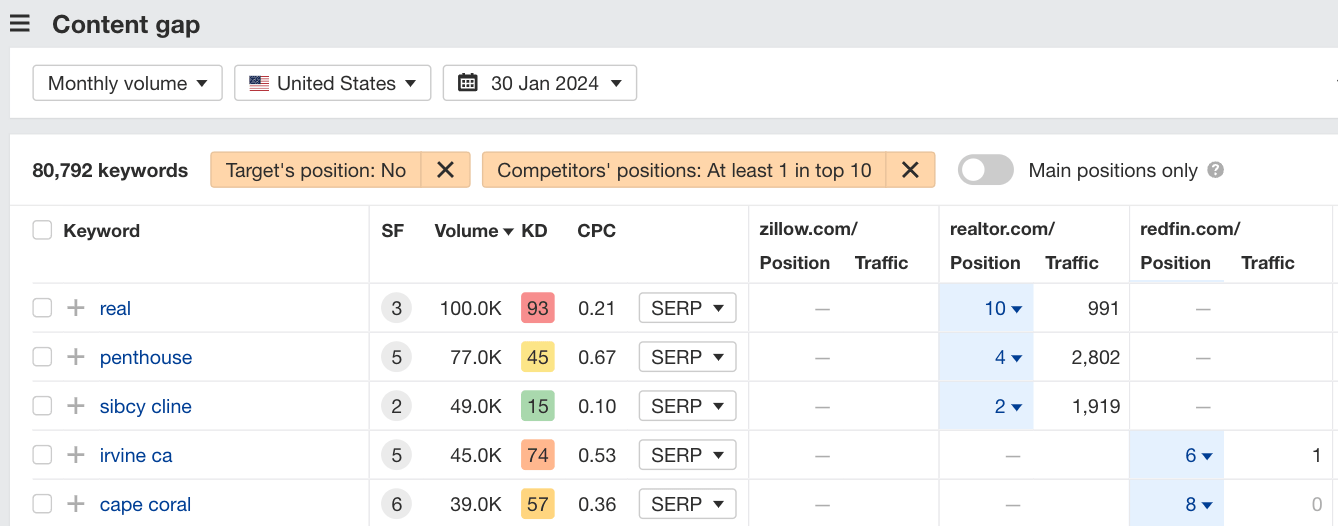

To find what you and your competitors deliver, use the Content Gap report in Ahrefs’ Competitive Analysis tool. This will show you keywords your competitors rank for but you don’t.

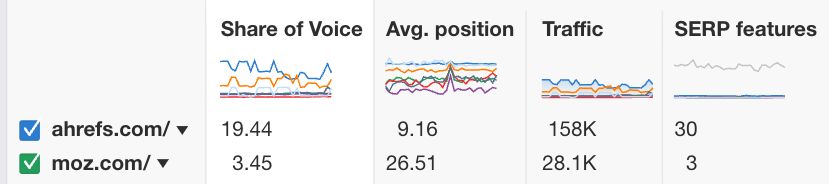

To monitor your competitor’s visibility over time use Ahrefs’ Rank Tracker. Check your website against your competitors in the Competitors > Overview report and pay particular attention to things like:

- Share of Voice

- Traffic changes

- SERP feature visibility changes

pro tip

If you want to go one step further, try combining the two keyword lists in a spreadsheet using a vlookup formula or a pivot table. By doing this, you’ll find the keywords people look for that neither you nor your competitors rank for. These gaps are hidden goldmine opportunities that can improve your visibility with very little friction or competitive resistance.

Final thoughts

Doing competitive intelligence the right way comes down to being well-informed about:

- What influences your customer’s buying decisions

- What’s happening in the market

- What your competitors are doing and how they’re thinking about the market

You can use a number of strategies to differentiate your business from competitors. Ultimately, however, it’s your customers that have the final say. They’re the ones that vote for the company that best fulfils their needs with their money.

And where money flows, markets grow.

If you’ve got any questions or are doing some cool things in your competitive intelligence programs, please reach out on LinkedIn!

Content Copyrights Belong to The Author. All Rights Reserved.

We're A Dallas Digital Marketing Agency That is Experts At Social Media Marketing, Website Design and Emarketing and Promotion.